Late autumn is often a time of reckoning for sellers: “Is my home priced right to sell before the snow flies?” At the same time, excited, yet anxious, buyers see that prices are being reduced while the available inventory appears to slip through their fingers. Luckily, for those eager to find their ideal “Tahome”, the beautiful weather is still bringing new listings to market every day. Don’t give up your search!

Late autumn is often a time of reckoning for sellers: “Is my home priced right to sell before the snow flies?” At the same time, excited, yet anxious, buyers see that prices are being reduced while the available inventory appears to slip through their fingers. Luckily, for those eager to find their ideal “Tahome”, the beautiful weather is still bringing new listings to market every day. Don’t give up your search!

Click here for our complete Tahoe-Truckee Market Report

In a quarter-to-quarter comparison of Tahoe Truckee SFR sales over the past two years, we can see a normal trend; that median prices peaked in the 2nd quarter, and softened by about 3-4% in the 3rd quarter. What has been different in 2018-19 over the previous five years is that unit sales have dropped, dramatically in some areas, as a reaction to inflated prices. In Sierra Meadows/Ponderosa Palisades, median and average prices are up a whopping 30% and 51% percent respectively, and the number of SFR’s sold in the first 3 quarters of 2019 is half that of the same time period in 2018. Click here for Sierra Meadows/Ponderosa Palisades numbers.

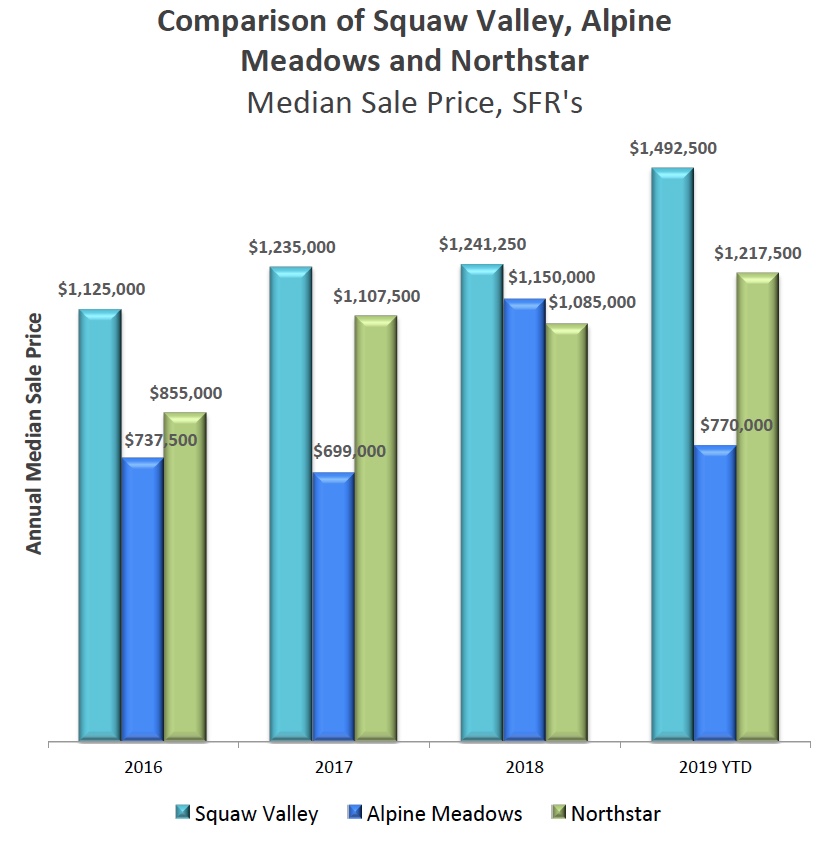

The three North Lake ski areas have bucked the trend of inflated prices and low volume, showing a slight dip in prices, shorter listing periods and big jumps in the number of homes sold. Most other Tahoe-Truckee areas have had to accept less market activity for the payoff of sellers reaping higher rewards.

Other notable figures in this quarter’s report: it’s a buyers’ market in the lakefront condo sector, with prices dropping sharply over 2018. Also, sellers everywhere should take heart in the fact that while it may feel like properties are moving like molasses in January, we aren’t seeing the extreme market slowdown that occurred when prices soared in 2006.

Click here for our complete Tahoe-Truckee Market Report

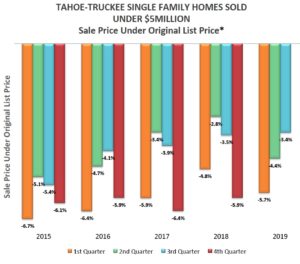

Sellers: is it your time of reckoning? Looking at statistical data, homes that sell in the fourth and first quarters have usually sold for about 6% less than their original asking price, versus 3-5% in other quarters. (In our analysis, we excluded homes over $5 million because they often follow different, more extreme, trendlines.) If you are waiting for your home to sell as Old Man Winter comes rushing towards us, it might be a good time to look at the current versus original price and see how far outside the norm you may lie.

Sellers: is it your time of reckoning? Looking at statistical data, homes that sell in the fourth and first quarters have usually sold for about 6% less than their original asking price, versus 3-5% in other quarters. (In our analysis, we excluded homes over $5 million because they often follow different, more extreme, trendlines.) If you are waiting for your home to sell as Old Man Winter comes rushing towards us, it might be a good time to look at the current versus original price and see how far outside the norm you may lie.