In a galaxy far, far away…

Watching real estate trends can feel like looking at images from the Webb telescope; we’re always looking back in time. Real estate, especially in a resort home market like Tahoe-Truckee, can take months or even years to catch the light beams being emitted in the moment by other economic indices. For example, the historic median price low here was 2012, 4 years after the mortgage meltdown of 2008, and it took 8 more years to get back to the giddy price highs of 2006.

If we’re lucky, starlight is getting a little closer, and Tahoe-Truckee will respond more quickly than in the past to outside stabilizing forces such as the federal interest rate hike.

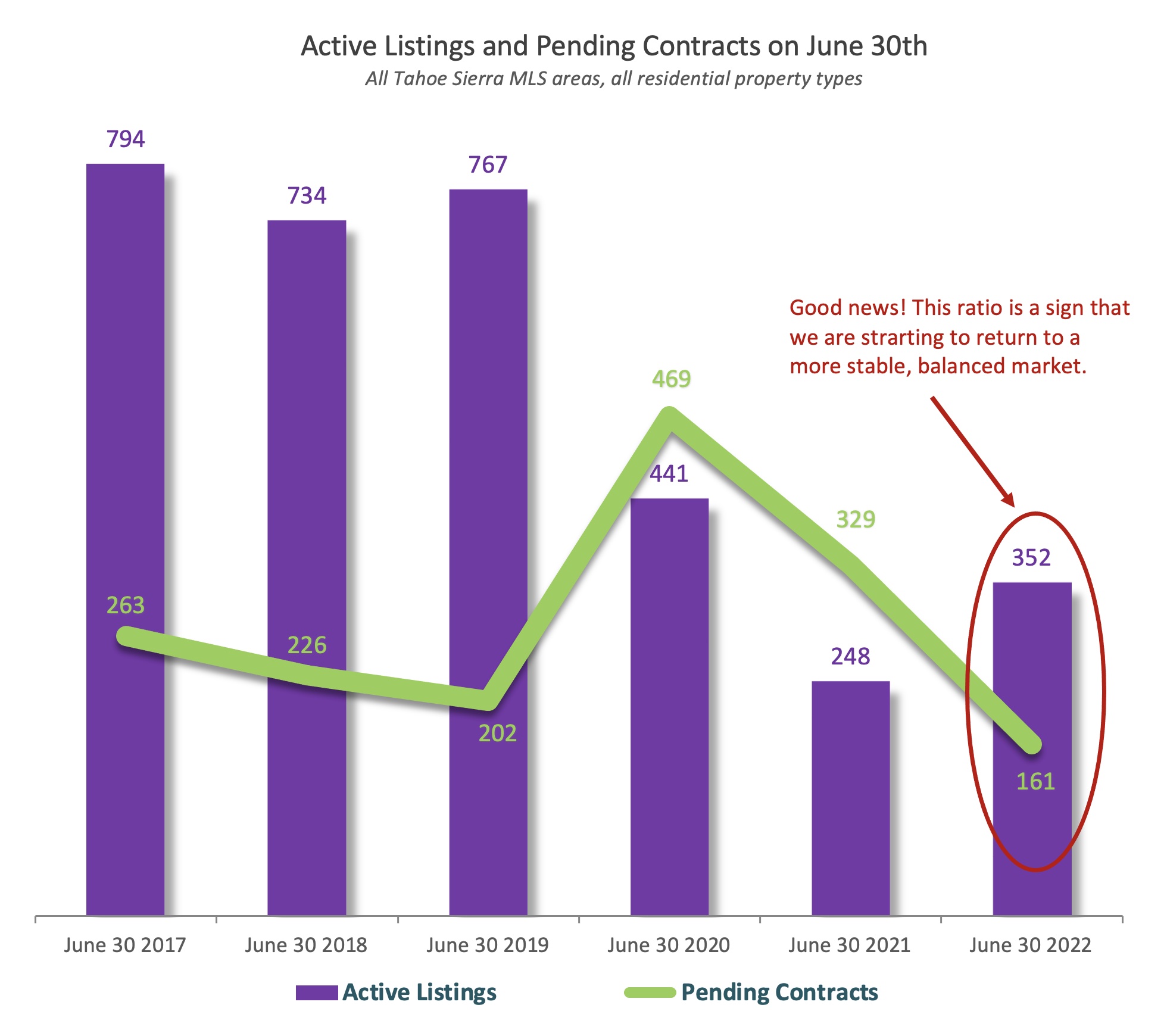

We’ve said it before and we’ll say it again, in as many different ways as there are galaxies in the universe: the path to market sanity is more listings!

CLICK HERE FOR ALL MARKET NUMBERS

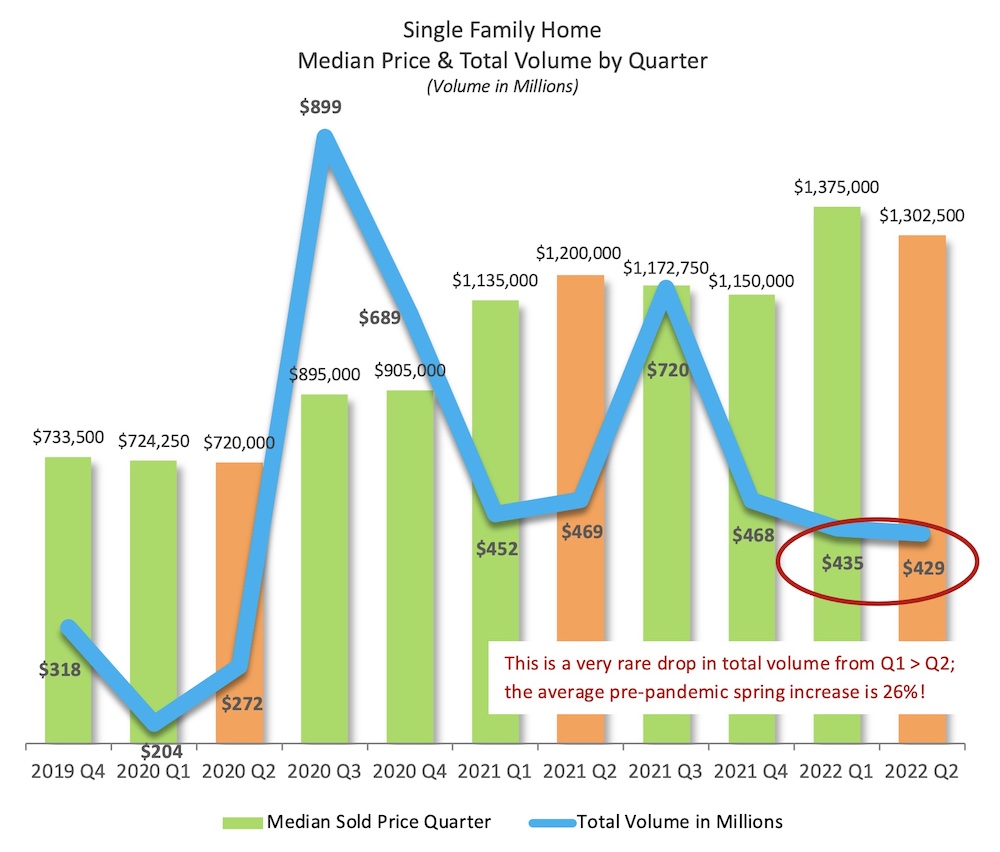

A healthy spring market in Tahoe should show total volume increases over first quarter ranging from 10%-40%, so even a small drop, as we’re seeing in 2022, is concerning. We hope more inventory will prevent this from ever happening again!

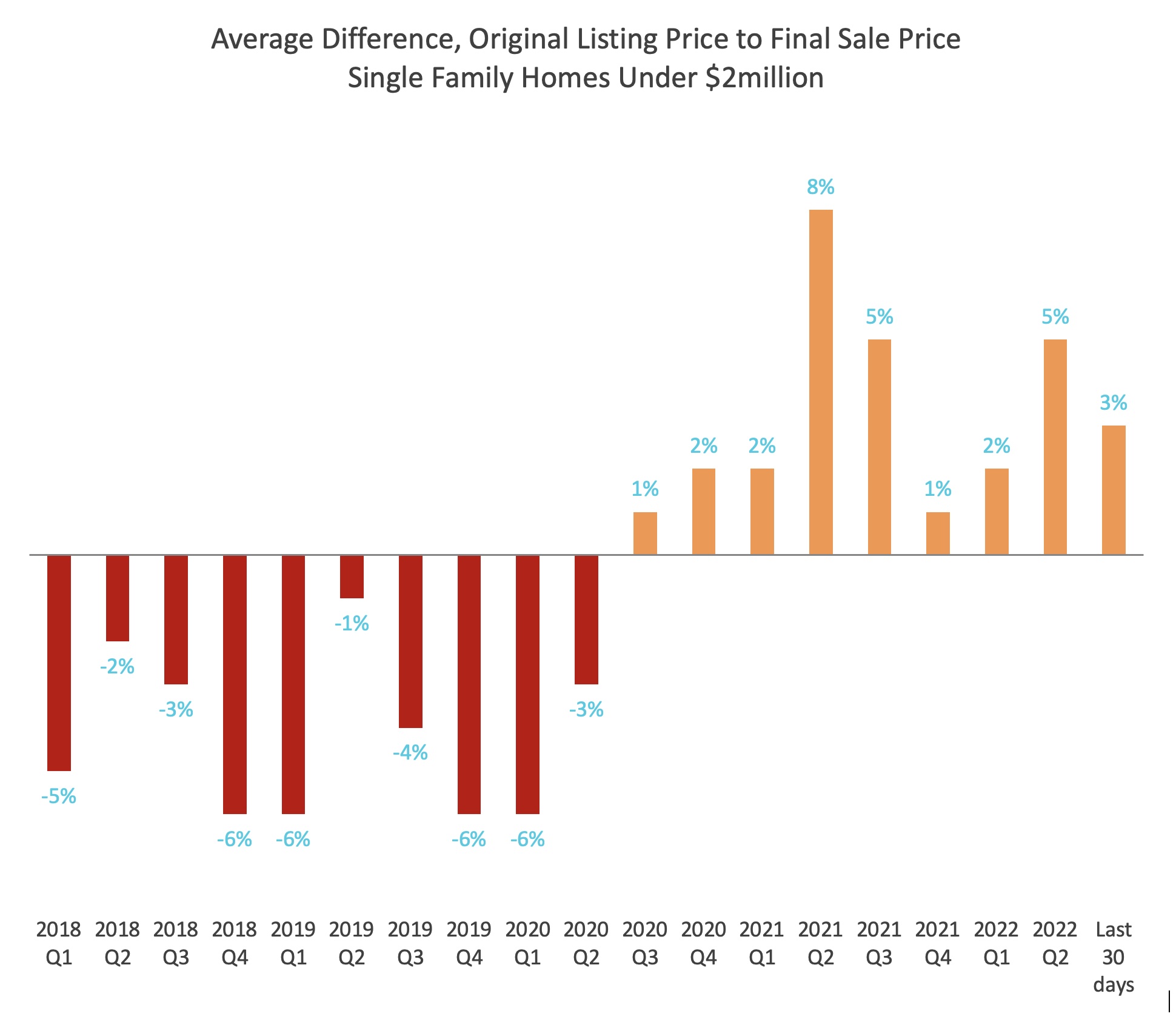

Sales above asking may make sellers feel like they’ve won a free trip on a SpaceX flight, but we’ll all feel a bit more grounded if negotiations return to the traditional, predictable, 2%-6% sales-under-asking ratio.

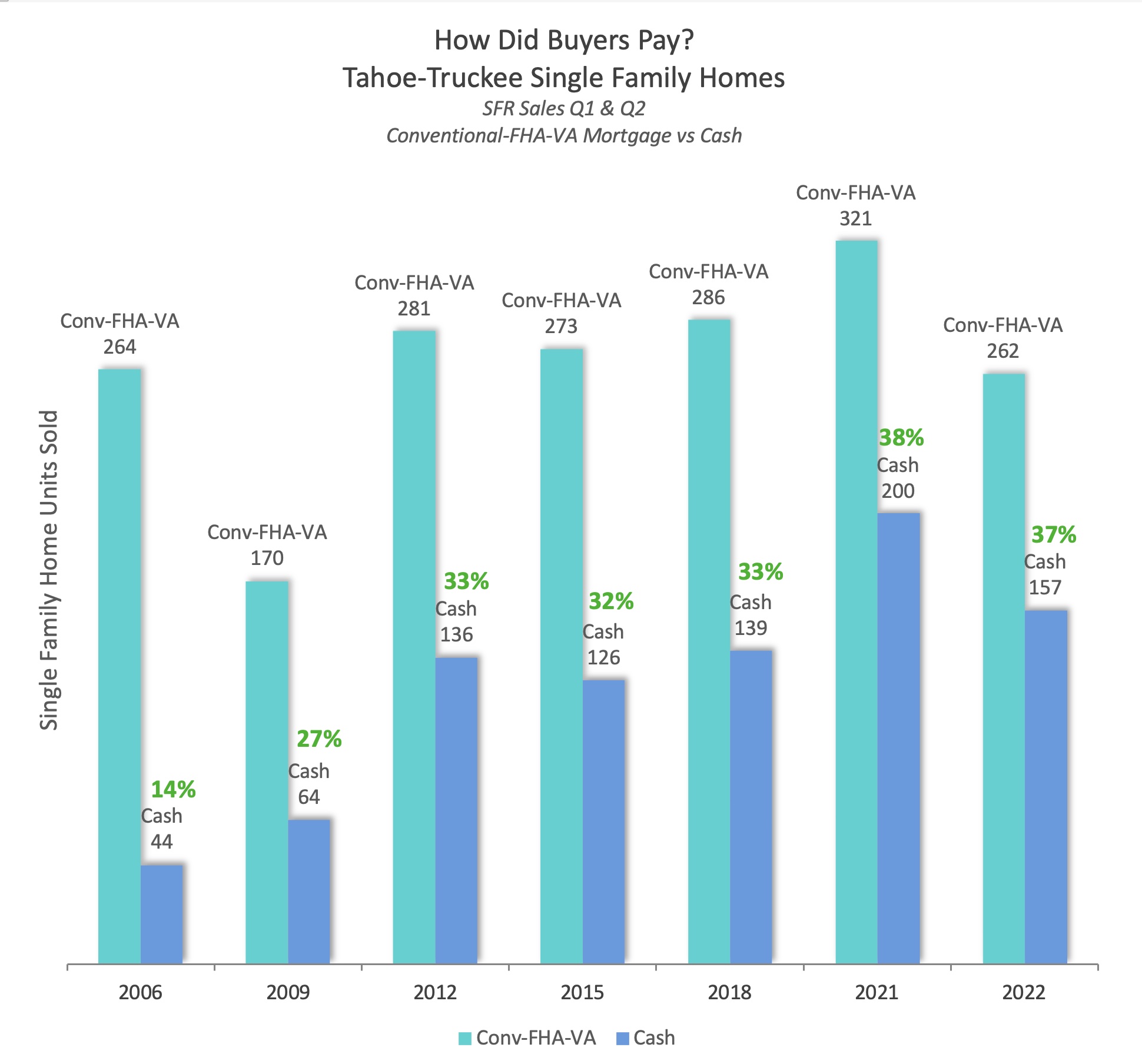

While the influx of cash buyers in the past few years may feel like a giant solar flare sending heat waves in all directions, Tahoe-Truckee numbers tell a slightly different story. Yes, we all know cash wasn’t king back in 2006, when banks were giving away money like lollipops at the teller. But the modest 4% increase in cash purchases since 2012 is no interstellar storm—cash buyers, at least in this area, cannot be solely blamed for struggling buyers’ woes. FULL MARKET REPORT

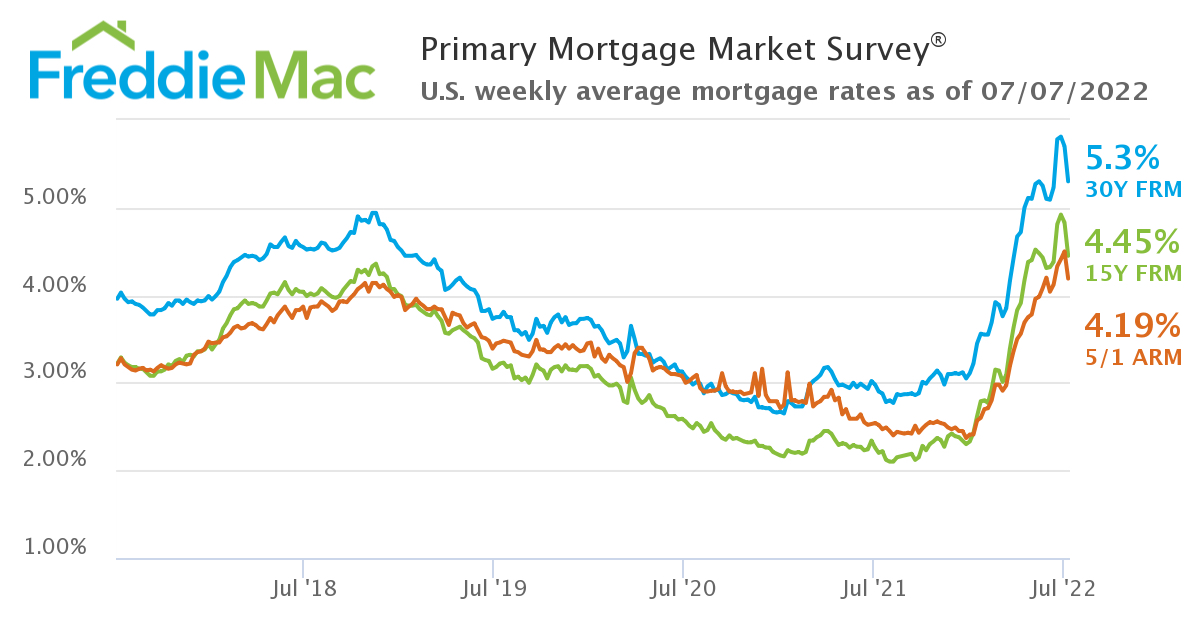

On the flip side of looking at cash buyer stats, we find it helpful to get historcial perspective on mortgage rates. The Freddie Mac site provides clear and reassuring data to remind us that the new rates do have precedent.

Leave a Reply