There are many reasons, both tangible and emotional, why a bigger down payment can make a lot of sense. On the other hand, if it takes too long for you to save up that chunk of cash, you may not be winning. This great financial summary from Keeping Current Matters does the math on how a bigger down payment helps…or how waiting too long can hurt.

There are many reasons, both tangible and emotional, why a bigger down payment can make a lot of sense. On the other hand, if it takes too long for you to save up that chunk of cash, you may not be winning. This great financial summary from Keeping Current Matters does the math on how a bigger down payment helps…or how waiting too long can hurt.

From the KCM Blog:

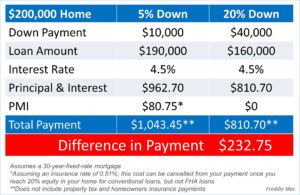

Some experts are advising that first time and move-up buyers wait until they save up 20% before they move forward with their decision to purchase a home. One of the main reasons they suggest waiting is that a buyer must purchase private mortgage insurance if they have less than the 20%. That increases the monthly payment the buyer will be responsible for.

However, we must look at other aspects of the purchase to see if it truly makes sense to wait.

Are you actually saving money by waiting?

CoreLogic has recently projected that home values will increase by 4.3% over the next 12 months.

If you decide to wait until you have saved up a 20% down payment, the money you would have saved by avoiding the PMI payment could be surpassed by the additional price you eventually pay for the home. Prices are expected to increase by more than 3% each of the next five years.