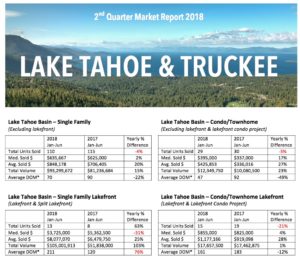

Linda Granger’s First Half 2018 Tahoe-Truckee Market Report: Up, up and away! The Tahoe/Truckee real estate market is soaring, with positive numbers across the board and the best (lowest) “Days on Market” stats we’ve seen in a very long time. Single Family Residence average closed sale prices are up 20% in the Tahoe Basin, and a whopping 28% in both Truckee and the three major North Tahoe ski areas. Wow, just WOW! Sellers are skipping through this year’s mind-blowing wildflowers like Julie Andrews in The Sound of Music. [Seriously, if you haven’t gotten out for a wildflower walk in the past couple of weeks, you’re missing a historically epic bloom!]

Linda Granger’s First Half 2018 Tahoe-Truckee Market Report: Up, up and away! The Tahoe/Truckee real estate market is soaring, with positive numbers across the board and the best (lowest) “Days on Market” stats we’ve seen in a very long time. Single Family Residence average closed sale prices are up 20% in the Tahoe Basin, and a whopping 28% in both Truckee and the three major North Tahoe ski areas. Wow, just WOW! Sellers are skipping through this year’s mind-blowing wildflowers like Julie Andrews in The Sound of Music. [Seriously, if you haven’t gotten out for a wildflower walk in the past couple of weeks, you’re missing a historically epic bloom!]

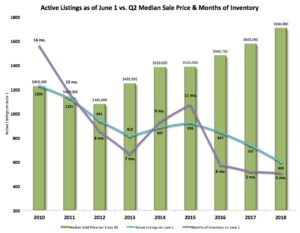

True, higher prices and shorter listing periods are almost always signs that inventory is tight, and summer 2018 is no exception. This year’s “market absorption rate”, or the speed at which the available inventory will sell, is higher than it’s been since the recession, which means that the ratio of demand to supply is nearing peak levels. What we’d all like to see is more new listings and continuing healthy numbers in the ‘units sold’ category, to indicate bustling market activity–properties successfully changing hands. So far so good: as of this report, you can see that units sold is down slightly in several areas but has not dropped precipitously, as it did in 2006. The 2nd quarter 2018 units sold figure is 29% higher than that peak year!

MY SPECIAL REPORTS FOR 2nd QUARTER 2018:

- Martis Camp numbers are surging in 2018, with sales accounting for 36% of the Truckee market in terms of dollar volume, and 9% of units sold. Interestingly, however, this chart also reveals that for the second quarter running, Truckee SFR median sale price without Martis Camp has exceeded the Tahoe Basin median price.

Click here for Martis Camp chart with numbers - Active Listing/Sales Price/Months of Inventory (scroll down or click here) Note that “months of inventory”, which is calculated based on the number of closed sales in a given month in relation to the active listings, doesn’t always track with higher prices and lower inventory. This is because market activity can flourish–or slow down–in a wide variety of pricing and inventory environments.