Short Sales and REOs:

A short sale is a property that is being sold for less than is owed on the property.

This often occurs when the borrower cannot afford to pay the mortgage loan on the property and the lender decides that selling the property at a moderate loss is better than going through the foreclosure process. A short sale is often not a “short” process and it can take up to months to get a response from the bank or lender. Short sales are often a better route for sellers so they do not have to go through the foreclosure process and a short sale is not as bad on their credit.

This often occurs when the borrower cannot afford to pay the mortgage loan on the property and the lender decides that selling the property at a moderate loss is better than going through the foreclosure process. A short sale is often not a “short” process and it can take up to months to get a response from the bank or lender. Short sales are often a better route for sellers so they do not have to go through the foreclosure process and a short sale is not as bad on their credit.

A real estate owned (REO) property is one that has been through the foreclosure process and is in possession of the bank or lender.

A property at this stage has usually gone unsuccessfully to auction and then comes back on the market as a bank-owned property. The process of purchasing a REO property is typically much quicker and easier than purchasing a short sale property. Click on the link for more information about California Short Sales.

View Tahoe/Truckee Short Sales

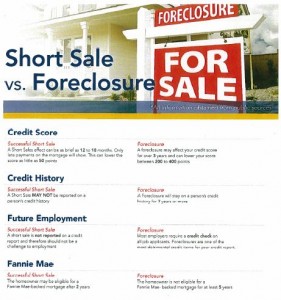

How is a Short Sale Seller’s Credit Affected?

Fair Isaac released a report that says credit scores are affected about the same, whether a seller does a short sale or foreclosure. Fair Issac says the average points lost on a credit score are as follows:

- 30 days late: 40 to 110 points

- 90 days late: 70 to 135 points

- Foreclosure, short sale or deed-in-lieu: 85 to 160

- Bankruptcy: 130 to 240

- Foreclosure or Deed-in-Lieu of Foreclosure

Both of these solutions affect credit the same. Sellers will take a hit of 200 to 300 points, depending on overall condition of credit. This means if a seller’s FICO score before foreclosure was 680, it could dip as low as 380. That being said, there is the potential for the ding to vary significantly from person to person, depending on other compensating factors.

- Short Sale

The effect of a short sale (providing the sellers are more than 59 days late) on a seller’s credit report is identical to that of a foreclosure. The ding on credit will show up as a pre-foreclosure in redemption status, which will result in a loss of 200 to 300 points. This means a short sale seller with a previous FICO of 720 could see it fall from 520 to 420.

Foreclosure:

- VA loans: 2 years

- FHA loan: 3 years

- Conventional: 7 years

Short Sale:

- Conventional: 2 years (if 20% down payment)

- FHA: 3 years

Note: All of this of course assumes credit/income qualifications are meeting standard guidelines.

Contact Linda Granger for more details.